Bad v. Good GDP

When will they hard-land the global financial bubble?

Context: finflation

Bad GDP

One way to understand finflation is the accounting of bads (instead of goods) in the GDP. If we subtract all the industries or economic activities that cause more harm than good, we’d end up with a smaller GDP but with a richer and higher quality of life, because we wouldn’t have so many health issues to treat, thus a higher good-GDP.

Examples:

- Death industries such as the military industrial complex. U.S. “Defense” spending: $997 billion in 2024, or about 3.5% of GDP.

- Epidemic industries, causing

a) death (vaccines, organ transplants from the falsely declared brain dead)

b) diseases (statins, vaccines, mammograpies)

c) addiction (opioids, benzos, controlled substances and psychotropics/CNS $55 billion 0.18% GDP, add addiction treatment e.g. $4 billion for opioid addiction only)

d) ruining health (agrichemicals $33.5 billion, artificial sweeteners $2.2 billion, contraception $8 billion, IVF $9 billion, gender transitioning $1 billion, surrogacy $6 billion, tobacco $100 billion 0.35% GDP, irrestricted alcohol $360 billion including accidents 1.5%).

Bio-Pharma: $630 billion, 2.2% GDP, including unsafe and ineffective products.

Mis/Overtreatment: 5-10% of GDP when including externalities like lost productivity from illness.

Abortion $133 billion in economic drag.

Euthanasia: $6 billion.

Fast food/QSR $400 billion; 1.4% of GDP; obesity costs 1% direct, up to 3% indirect (lost productivity).

Sugary beverages $100 billion 0.34% GDP, linked to obesity, type 2 diabetes, and heart disease $30 billion, with total economic burden (including lost productivity) up to $70 billion per year.

- Creating negative externalities (e.g. pollution 7-14% of GDP, including $790 billion+ in health/environmental damages) which cost more to remedie than the accounted added value

- Useless activities: for example accounting for the jobs of thousands of people employed in prosecuting, collecting, calculating and reporting taxes and many other activities related to useless government programs and agencies. Federal spending ~23-24% of GDP ($6.8-7T), with tax collection/compliance costing ~0.5-1% (IRS budget ~$12B + private compliance $400B). Broader “useless” bureaucracy: ~1-2% of GDP in overhead for programs like entitlements.

- Lawfare and those exploiting the legal system to achieve injustices. Legal Services Industry: $388 billion, 1.4% of GDP.

- Inneficient industries (or misallocated resources) subsidized or promoted by regulaton such as “clean” energy 23% of US electricity (investment $280 billion in 2025) or EVs ($140 billion). Trump stopped $13 billion in clean energy funds and the $7,500 EV tax credit.

- Immoral industries that cause short or longterm harm (prostitution $10 billion, porn $10 billion, masturbation “sextoys” 11 billion, marijuana $30 billion, gambling $72 billion, comprehensive sexuality education, etc.).

- Immoral media promoting vices, violence, promiscuity, etc. $580 billion (2% GDP), but “vice-promoting” subset (e.g., explicit content) 0.2%+. Hard to isolate; includes advertising for “bads” above.

- Speculation industry: derivatives, high-frequency trading, or bubbles (e.g., crypto, past subprime) inflate financial sector profits (~27% of corporate profits pre-2008 peaks) but lead to crises (2008 cost trillions in lost output/bailouts). Financial sector is 8% of GDP. Crisis costs are episodic but huge: 2008 20% GDP loss.

- Lobbying for those industries

- Bad quality or defective products, recalls. 1.5% of GDP. Foodborne illness alone (related to defective food) burdens $75B/year in health/economic losses.

- Planned Obsolescence: 2% GDP via accelerated replacement cycles.

- Waste, previously accounted as a good.

Total “bads” could represent 20%-30% of GDP, though it’s hard to to add since they are subsets of almost every category.1

Masons direct GDP spending towards increasing bads production, especially by hijacking the Government budget and through incentives, disincentives and regulations.

The net GDP between goods and bads gets worse, even negative, if we give value to the loss of:

Life Expectancy (LE): average years lived.

Healthy Life Expectancy (HALE): years lived in good health.

Years of Potential Life Lost (YPLL): premature death burden.

Years of Life Lost (YLLs) due to premature death.

Years Lived with Disability (YLDs)

Disability-Adjusted Life Years (DALYs): measure overall health burden (burden of disease), combining the latter YLLs and YLDs

Of course, the loss of a human life is invaluable, but still life insurance and economists assign a low one.

1https://grok.com/share/bGVnYWN5_ff12668d-cf4e-46d7-ac9d-5111ba83a72e

Leprechaun economics

Another way to understand finflation is the Irish case: corporate tax strategies resulted in inflated growth, creating a “statistical shell”, where headline growth masks disconnected from everyday economic reality.

It’s like the “Pot of Gold” illusion: the surge is like finding a leprechaun’s gold (magical, unreal appearance), not real gold, i.e. genuine economic prosperity.

The statistical anomaly showed a huge sudden increase in Gross Domestic Product (GDP) that didn’t translate to more money in Irish pockets.

“Leprechaun economics” describes Ireland’s GDP surge, coined by Paul Krugman in 2016 after a 26% jump, caused by multinational corporations shifting intangible assets (like patents) for tax purposes, creating massive statistical growth that didn’t reflect the real, domestic economy or living standards, leading to distorted figures for GDP and debt-to-GDP ratios.

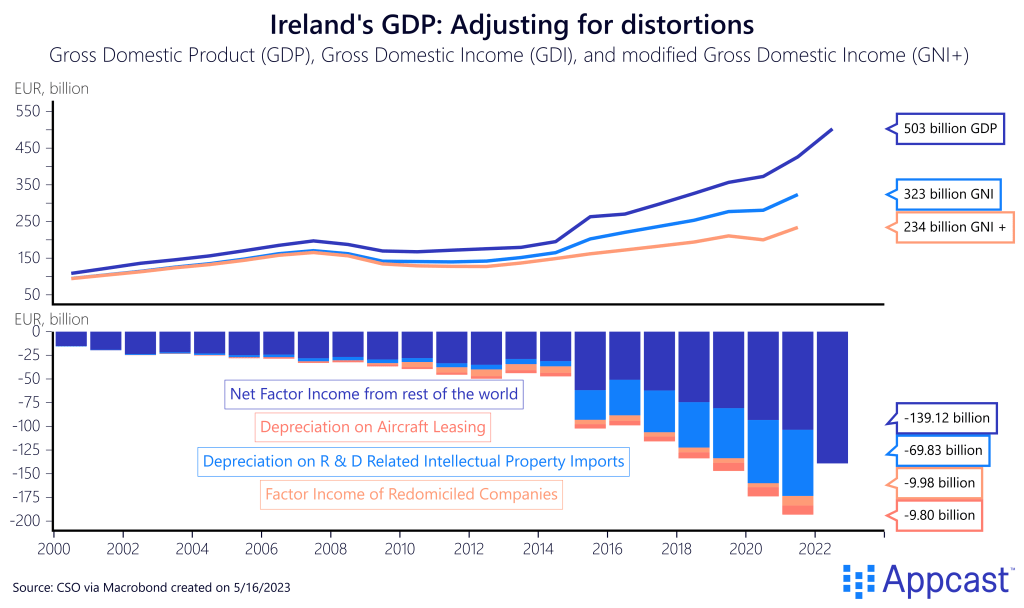

Irish GDP was just a little over 500 billion euros in 2022. Gross national income (GNI) is substantially lower though, by about 140 billion by subtracting:

- 70 billion of intellectual property (patents residing in Ireland)

- 10 billion of aircraft leasing and factor income of redomiciled companies (companies being headquartered in Ireland for tax purposes but having little economic activity in the country)

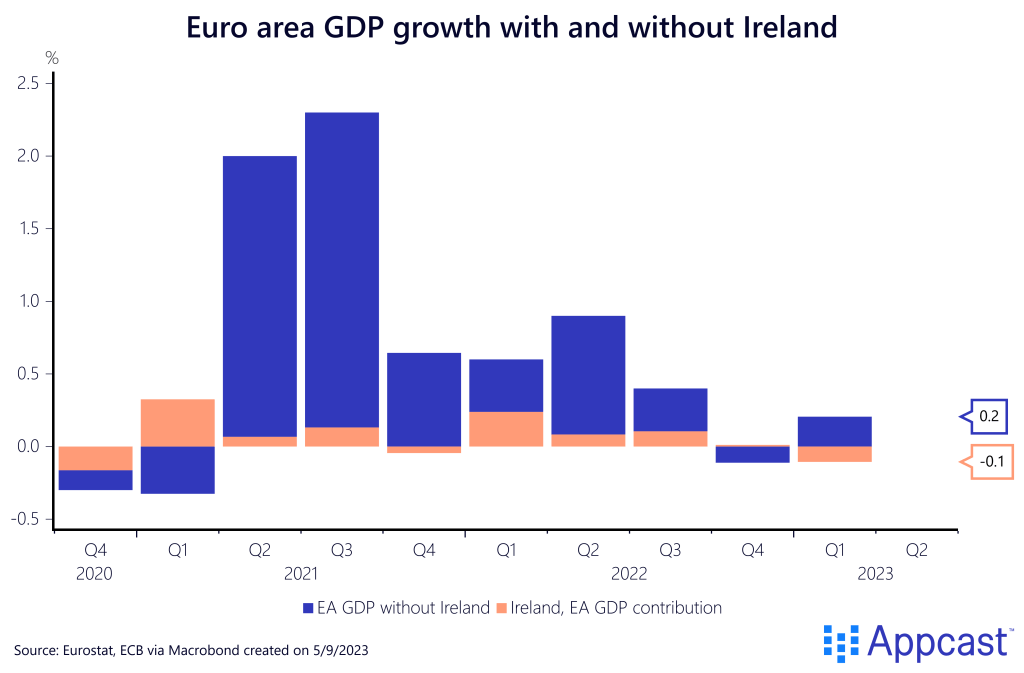

The size of the Irish distortion is so large that it even affects eurozone GDP and trade statistics. You know that there is something off when a country with five million inhabitants can distort the GDP of an economic area with more than 340 million people.

Ireland’s GDP contributed to almost half of eurozone growth in both Q1 of 2021 and Q1 2022, and Ireland was the only reason why eurozone GDP didn’t contract in Q4 of 2022. In Q1 2023, on the other hand, Ireland contributed -0.1 percentage points to eurozone GDP growth of 0.2%. In other words, eurozone growth would have been 50% higher if it wasn’t for Ireland’s negative contribution.1

In a similar way, the whole world has turned into a leprechaun economy, where there are massive amounts of virtual financial value with no relationship to the real economy, except that it is able to buy real assets, while so many fall for the Ponzi scheme, not realizing that when the virtual economy settles onto the real one, they will lose most, since the tangible is going to cost so many times more (e.g. a pen $1000 dollars? A phone, 10.000 USD?).

https://recruitonomics.com/leprechaun-economics-the-irish-growth-miracle/

Leprechaun

noun

(in Irish folklore) a small, mischievous sprite.

Synonym: pixie, goblin, elf, gnome.

In the 11th century Book of Invasions, it is told that the Milesians, (a Mediterranean people), invaded Ireland and conquered the early Irish inhabitants, the Tuatha de Danann, and forced them to give them their gold and live underground.

Was this the beginnings of the leprechaun legend of popping in and out of sight and shrinking from normal sized people to smaller stature, more fitting for the underground tunnels, and having a pot of gold at the end of the rainbow?

While leprechauns are a distinctly Irish fairy creature (mischievous shoemakers guarding pots of gold, part of Celtic mythology), gnomes and similar beings appear in traditions across many other countries, often under different names:

Scandinavia (Sweden, Norway, Denmark, Finland): Known as tomte, nisse, or tonttu—household or farm guardians who protect homes and animals but can play pranks if disrespected.

Germany: Strong association with mining spirits (Bergmännlein) and household helpers (like Heinzelmännchen in Cologne); garden gnome statues originated here in the 19th century.

Netherlands and Belgium: Called kabouters—underground or household spirits, shy of humans, wearing pointed red hats.

Switzerland and France: Linked to alpine variants like barbegazi (bearded, big-footed creatures in snowy mountains); Paracelsus’s work ties gnomes directly to Swiss traditions.

Other mentions include similar earth spirits in Iceland (as part of broader “hidden people” or vættir folklore), Poland, and parts of Eastern Europe, though these are often equated to dwarfs or brownies rather than “gnomes” specifically.

Spain and Portugal: “Duendes” (small, mischievous humanoid spirits often akin to goblins, elves, or gnomes) originate in Iberian folklore and spread colonization, blending with local beliefs in many regions. They are typically depicted as household or nature spirits that can be helpful, prankish, or malevolent, depending on respect shown to them.

Do leprechauns originate in pagan demons?

9 steps out of global tyranny

Sep 10

Time after time, most have become disappointed with their political leaders, in whom they placed their hopes for change. What they don’t realize is that the root of the problem is the system:

The PLAN revealed

This research took many many hours (including late night work), that will save you that amount of reading and organizing ideas. If you like it, please consider a paid subscription:

Are you prepping?

They are manufacturing a the huge infrastructure and financial crisis !

20 laws we need to exit Extermination Planet

Laws to exit planet prison

No Free Speech without Reach

Why was Bill Gates the mentor of Zuckerberg?

Zuckerberg really flipping?

15 Jan

What Has Happened To Mark Zuckerberg?

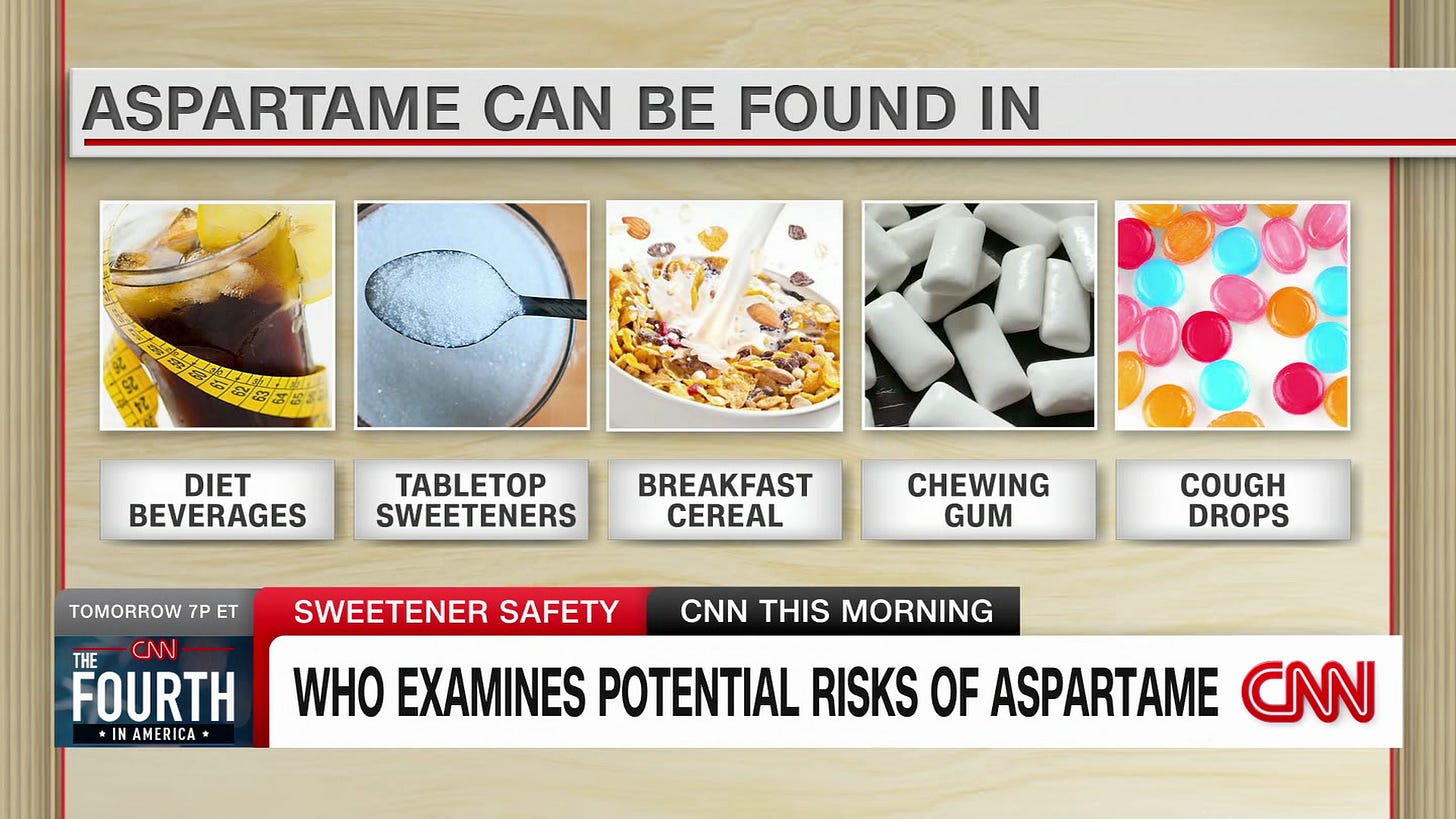

How Rumsfeld forced the approval of lethal Aspartame.

Artificial sweeteners, MSG, PFAS, Glyphosate ... go organic!

Why is food poisoning legal?

26 November 2023

This article would be another tool you could share to keep waking-up the still-trusting sleepwalkers: some reject discussing injections, but they’d be open to food.

Solutions for “this” Democracy?

Rethinking science

19 December 2023

Unless we change it, we’re doomed to the next PLANdemic. And yet, nothing has changed, only got worse! This isn’t pessimism: just a realistic call to ACTION in the medical and scientific freedom communities.

Rethinking education for the real 21st century:

Why not earning $60,000 per year for educating your own children?

Call to action

1. Please share in social networks!

10 shares = waking up more people + especial gratitude:

Waking others up SAVES lives or livelihoods.

For example, send them free ebooks:

Vax-Unvax: Let the Science Speak

The more the awakened, the sooner this nightmare will be over !

2. Please subscribe

Scientific Progress is a reader-supported publication. To receive new posts and support my work, please consider becoming a free or paid subs:

3. Show your love in the tip jar =)

1 dollar makes a difference !

4. Please consider “buy me a coffee”:

5. Please reconsider a paid subscription:

6. Please consider commissioning an article for the topic of your preference:

7. Pray

Most important of all: let’s pray for each other and the conversion of our enemies !

The evil we see in the material world is just the echo from the spiritual battle between God and Satan and their followers, either human or angelic.

Darkness grows because the light of faith is fading. Faith is the root of a plant that withers without the sunlight of love and the water of prayer. God is love: ask Him for more faith in love.

Fantastic framework for understanding what GDP actually measures versus what it should measure. The distinction between growth that depletes versus growth that enriches is something policy wonks dunno how to quantify, but this breakdown of 'bads' consuming 20-30% of GDP makes it tangible. I've worked in sectors where we basically existed to fix problems other industries created (environmental cleanup after industrial spills), and the absurdity of counting that mess twice in GDP never sat right. Your finflation concept perfectly captures how disconnected virtual financial growth has become from any real welfre improvements.

I think “people are asleep.” (unfortunately)