Finflation

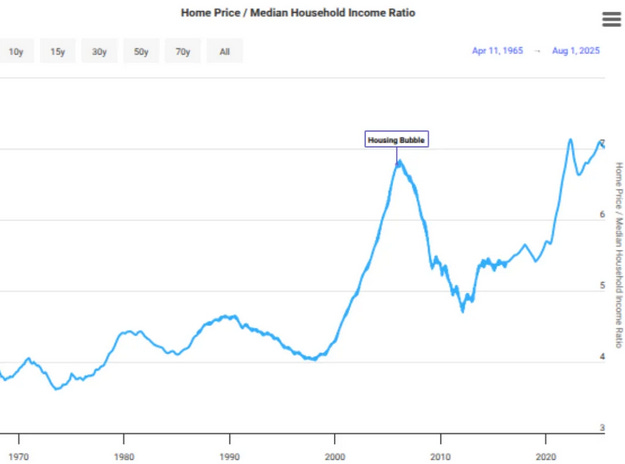

Financial inflation bubble designed to implode for imposing the CBDC digi-tatorship

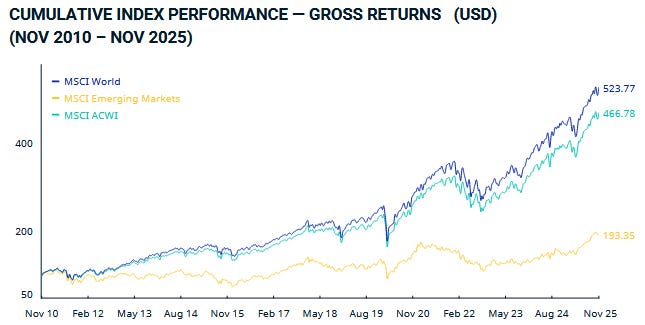

Stock exchange neverending boom

“Equities have outperformed bonds, bills, and inflation in every country included in the dataset”1: 23 core markets with uninterrupted data since 1900, all of which are developed economies (e.g., USA, UK, Australia, Canada, Japan, Germany, France, Switzerland, and others in Europe and the Asia-Pacific).2

Why do stock exchange indexes in every single developed country of the world increase in value over inflation? Where’s all that money coming from and why is it constantly being poured on the stock markets? Why did the indexes increase exponentially since the 2008 mortgage crisis? It’s just a money laundering Ponzi scheme!

Key Aggregated Developed Market Indexes:

MSCI World Index: the most widely followed global benchmarks, capturing large and mid-cap representation across 23 developed market countries. The U.S. is a significant portion of the index.

Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the UK, and the US. https://www.msci.com/documents/10199/178e6643-6ae6-47b9-82be-e1fc565ededb

STOXX Developed World Index: market capitalization-weighted index designed to represent the performance of large and mid-cap companies across developed markets, covering approximately 85% of investable market capitalization. https://stoxx.com/index/swdr/

3. S&P Global 1200: This index aggregates several regional “building block” indices (including the S&P 500 for the U.S., S&P Europe 350, S&P Topix 150 for Japan, etc.) to provide a comprehensive view of developed global equity markets.

https://www.spglobal.com/spdji/en/indices/equity/sp-global-1200/

1. Global Investment Returns Yearbook 2025

Public summary edition (PDF): https://www.ubs.com/global/en/investment-bank/insights-and-data/2025/global-investment-returns-yearbook-2025/_jcr_content/root/contentarea/mainpar/toplevelgrid_copy/col_1/innergrid_copy/col_2/actionbutton.0813156672.file/PS9jb250ZW50L2RhbS9hc3NldHMvd20vc3RhdGljL2Npby9kb2N1bWVudHMvZ2lyeS0yMDI1LXN1bW1hcnktcHVibGljLnBkZg==/giry-2025-summary-public.pdf

Elroy Dimson, Paul Marsh, and Mike Staunton. Triumph of the Optimists: 101 Years of Global Investment Returns (2002, Princeton University Press). https://press.princeton.edu/books/hardcover/9780691091945/triumph-of-the-optimists

2Global equities delivered ~5% annualized real return over the full period (varying by country, with USA highest at ~6–7%, others lower but still positive). No developed country in the dataset shows negative long-term real equity returns — even those impacted by wars, hyperinflation episodes (e.g., Germany, Japan post-WWII recoveries dominated long-term outcomes), or economic challenges ended with positive real performance over the century-plus horizon.

Shorter periods (e.g., 30–50 years) can show flat or negative real returns in individual developed markets (e.g., Japan’s “lost decades” since 1990 produced near-zero or slightly negative real returns). However, over the very long term (100+ years), the evidence shows consistent outperformance of inflation in all studied developed countries.

This reinforces the “equity risk premium” as a robust historical phenomenon in developed markets, though past performance is no guarantee of future results. For investors, global diversification remains key to capturing this premium reliably.

Monetary illusionists

Hosea 8:1, 7

“Because they have ... trespassed against my law ... they have sown the wind, and they shall reap the whirlwind ...”

Think about a monopoly game where you give all players twice the money to spend on the board’s assets. Of course, prices will double, since everyone can spend double. Everyone should end up relatively equal in this theoretical game, but in real life, some get more money than others.

1. The larger the monetary base, the larger the inflation. Who creates the base?

a) Government, by printing colored papers we assign value to, but has zero real value. b) Freemasons create financial “value” out of thin air as explained later.

Imagine a gold river. Those closest to the source get more, than those further downstream. Who is closest to the government’s golden river? Lenders, the banking, financial and commercial credit system.

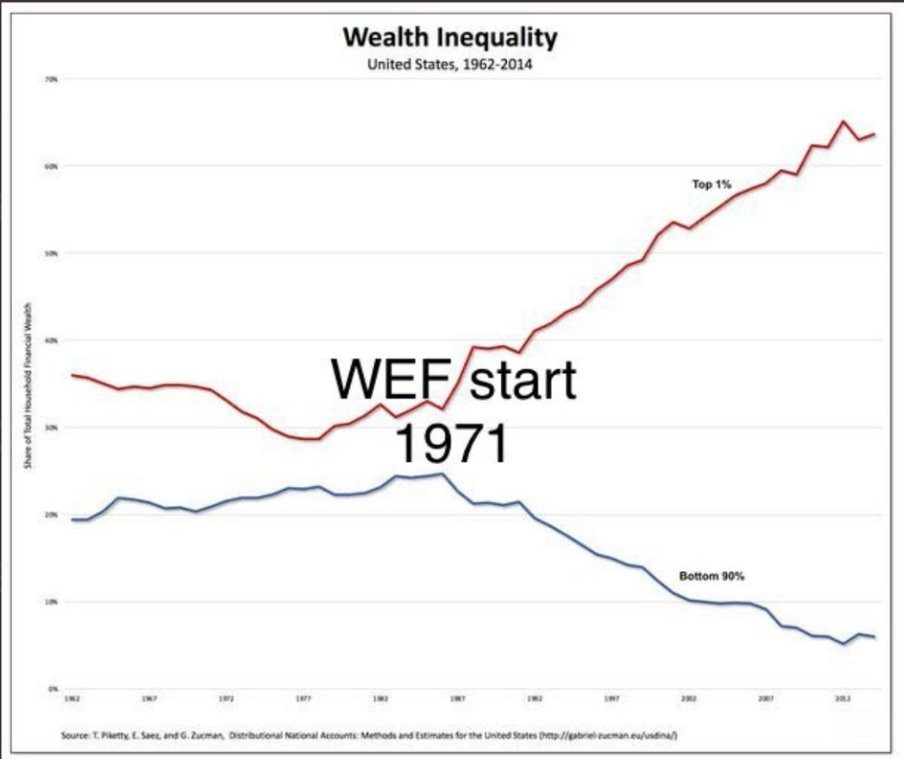

2. Whoever creates the M base, not only receives more money from the forgery but also suffers less inflation. The richer gain from inflation by another way: real assets shield you from the monetary theft. Who has less assets? The poorer.

3. Finally, holding money, means paying double tax. On one hand, the opportunity cost of not investing it (the real interest rate), while on the other, inflation. Which class holds more idle money in proportion? The working class, the poorer.

Conclusion: among other systems in place, paper currency and inflation is a sophisticated stealth form of taxing and skimming the poor.

Note: recessions were rarer since 1973, due to the excess monetary base

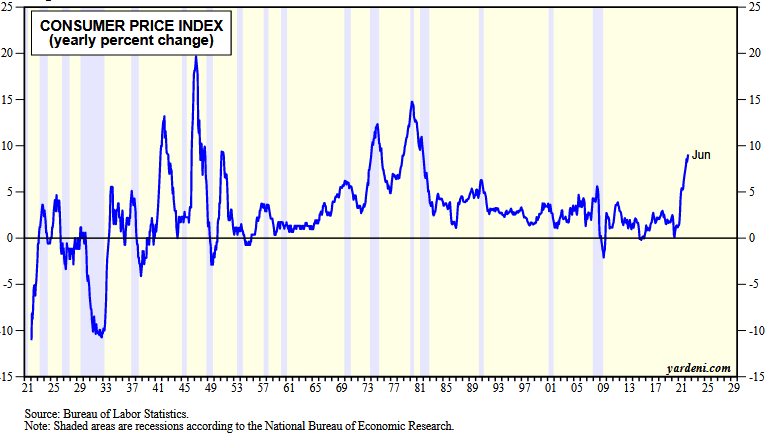

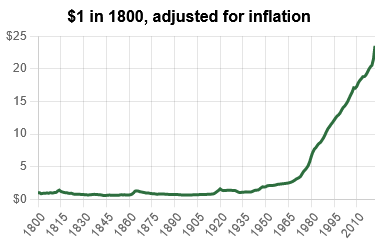

USD inflation since 1800

Annual Rate, the Bureau of Labor Statistics CPI 1

How can they get away with the massive scam? Monetary illusion needs price changes to be slow and low. Considering that rates compound exponentially, with few exception like failed states (Argentina, Venezuela) if inflation (ca. 10%) plus real interest rates are over 15% for enough years, the scam would be too obvious for the poorer and the middle class, and they’d stop voting (low poll participation) or stop voting the enslaving corporate-political caste (if they let an alternative to exist), and the unrest could result in migration (voting with your feet) or riots/revolutions (voting with your fists).

A glimpse on the Consumer Price Index is worth a thousand words:

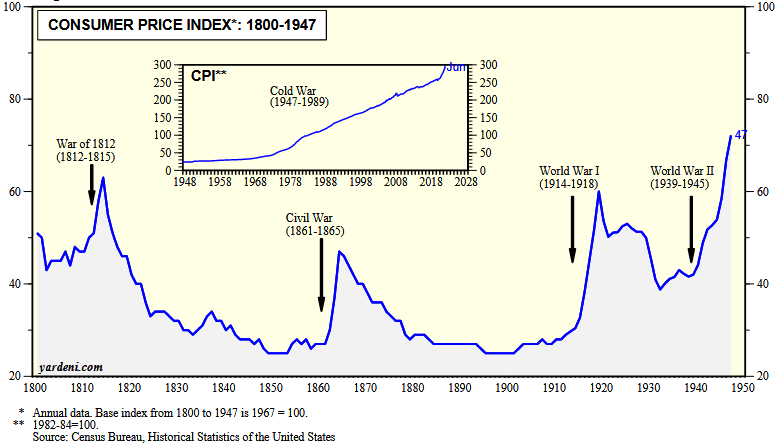

War means loss of productivity, especially through human lives and goods/materials consumed by the war effort. In wartime, inflation spiked due to increased government debt and excess spending over a shrinking economy For a hundred years, if it wasn’t for war, there would be no inflation.

After the 1907 guided financial panic, J.P. Morgan and other powerful masonic bankers created the Federal Reserve, the only private central bank in the world, to “save the financial system.”, i.e. to destroy people’s purchasing and saving power. 2 Since then, the USD lost over 96% of its value:

Until 1900 the dollar was redeemable in gold/silver, then only in gold until the 1930’s.

During the depression, freemason Roosevelt changed the dollar value from 66.46 cents per gram of gold to 112.53 cents per gram, stealing that half from the poorer’s pockets (in 1933, he made it illegal to own gold).

The Pecora Commission investigated the causes of the Wall Street Crash of 1929 and uncovered abusive practices and conflicts of interest by banks coordinated with the FED. Like all depressions, the 1929 crash was engineered by masons to buy the world back, at a bargain.

Since the depression, inflation rose continually because the government began the policy of deficit spending.

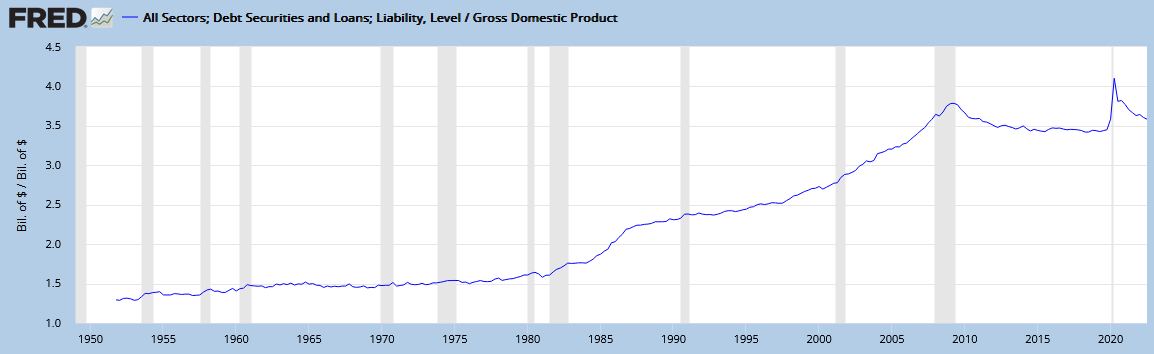

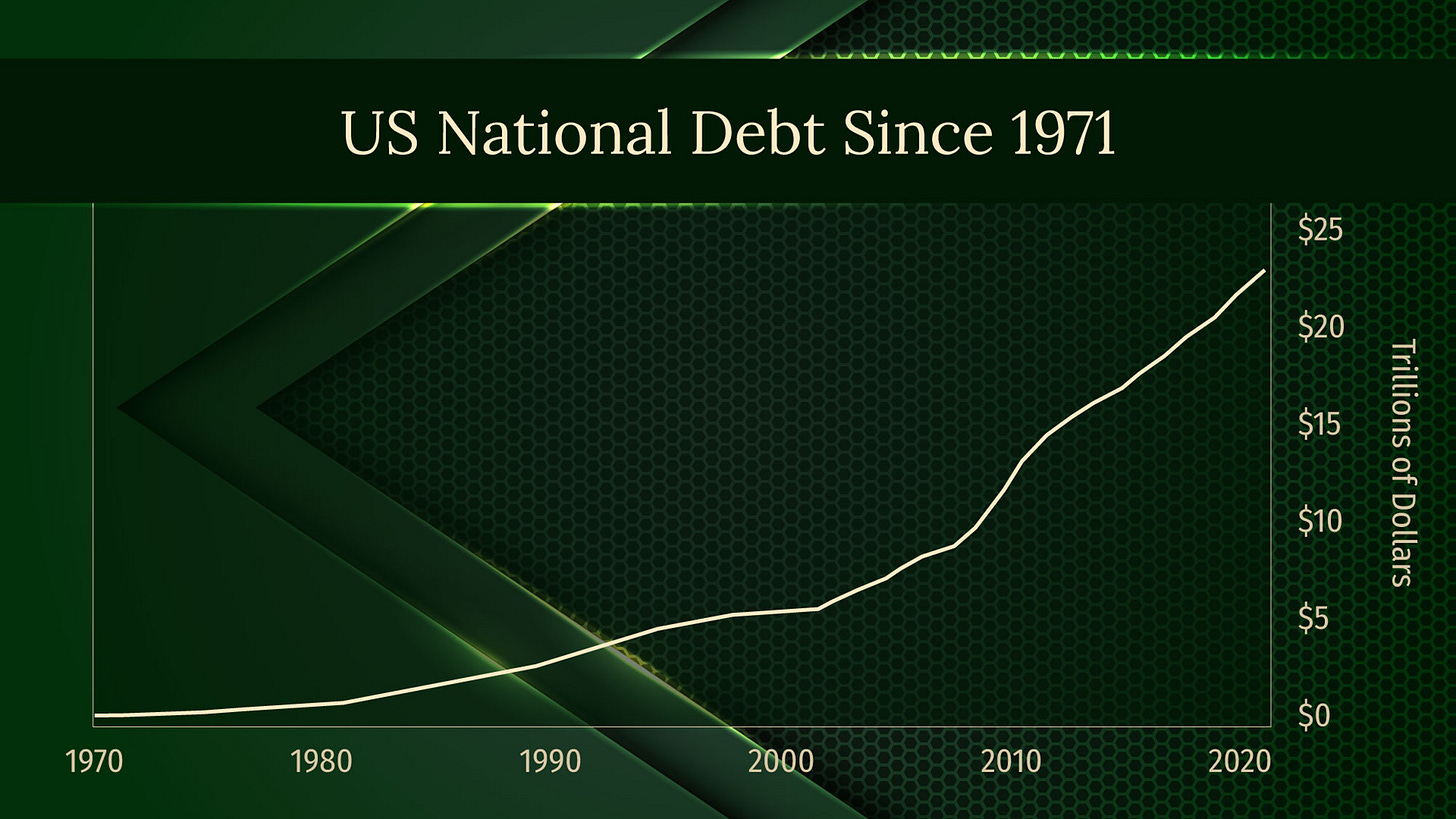

15 Aug 1971 was the end of the Bretton Woods system of fixed gold exchange rates established at the end of World War II. Ironically, to halt inflation and “create a new prosperity” (irony), freemason Nixon left the gold standard to print inflationary unbacked fiat money, either through the Fed or bank money creation, counterfeiting and laundry, all ideal options to increase government funding (debt):

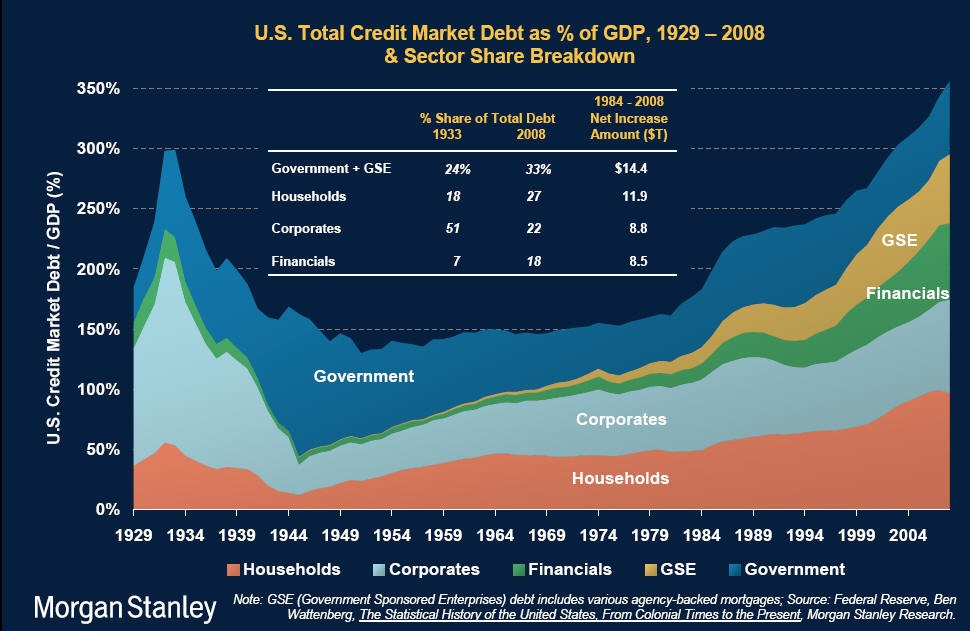

All Sectors; Debt Securities and Loans; Liability, Level / Gross Domestic Product

https://fred.stlouisfed.org/graph/?g=WRM up to 2022-07-01

More inflation, more household debt, more inequality.

G-debt and inflation, a convenience marriage set up by politicians’ thirst for deficit:

Dimson, Marsh, and Staunton wrote “Equities have outperformed bonds, bills, and inflation in every country included in the dataset”: 23 core markets with uninterrupted data since 1900, all of which are developed economies (e.g., USA, UK, Australia, Canada, Japan, Germany, France, Switzerland, and others in Europe and the Asia-Pacific).

Why do stock exchange indexes in every single developed country of the world increase in value over inflation? Where’s all that money coming from and why is it constantly being poured on the stock markets? It’s just a money laundering Ponzi scheme!

When the USD gold standard was abandoned, the real value of a dollar (adjusted for inflation) decreased linearly and then exponentially since 2018, which proves it is completely managed by the Federal Reserve and the BIS: 3

The CPI reflects the gap between the financial base and the economy. It’s growth is explained by

a) Finflation: term defined by this author in 1999 (also fininflation), which means finflation: inflation through the multiplier effect of ever increasing financial instruments creating “money” out of thin air (value), detached from the real economy.

The increase of the monetary base and credit base involves the creation of virtual money and impacts on prices, even more through government debt and credit (banking, commercial credit, credit cards) and traded derivatives.

b) Fake money: illuminati-insider Ronald Bernard explains how freemasons forge money and launder it through their controlled banks4 like Deutsche, JP Morgan, Citibank, Santander … basically, all the multinational Banks. By paying the careers of puppeticians they manage to get their people in key offices, especially in Central Banks and Mints, like the Federal Reserve and US Mint, accessing the original printing plates and anti-counterfeiting tech/suppliers(which they control). It’s because of the printing of counterfeit money that they manage to buy 75% of banks and multinationals listed in the stock exchanges. 5

They produce so much fake money that they need huge systems to launder it. That’s the reason they keep tax havens while infiltrating controlling agencies and judiciary system: “at least 2 trillion USD is laundered every year” in mason tax havens. They say it’s dirty money from “fraud, corruption, human trafficking, environmental crimes and terrorism, which harm society and undermine financial systems globally”6, but mostly it’s just their dirty money from all those activities (drug warlords responding to them!) and their financial crimes.

Nowadays, cash represents less than 0.1% of the financial assets. What they multiplied out of thin air with fractional banking is just the tip of the iceberg if we take into account what came next: anonymous stocks and bonds, cards (debit, credit, gift), warrants, securitization, money markets, derivatives, tokenization, ETF, hedging, international loans and aid, etc.

“Every dollar of criminal proceeds that is not seized can fuel more crime and destroy the lives of victims.” Or, in genuine terms, “Every dollar of criminal proceeds (aside from our own) that is not seized (by us) is competition that we cannot allow.” 7 Masons need to keep appearances and hate competition so less than 1% of global illicit financial flow is seized or confiscated. The other 99% is handled by them. And that doesn’t count crypto assets (they will be “conveniently” banned as soon as they implement global CBDCs).

Feb 2022, Homeland Security defined people who challenge the system as terrorists. Those who reject CBDCs will be considered a threat, financial terrorists, and that’s why global governance is after “asset recovery”, i.e. stealing your assets if you don’t comply with all the agenda 2030/ESGs.

People think that freemasons like Bill Gates are self-made men who made a fortune, legally. They don’t understand where their money really came from. Bill was presdestined to be a billionaire because he was the son of a high ranking mason, director of Planned Parenthood. He was given the Operating System monopoly for all PCs for nothing (IBM PC was basically the only one back then): he didn’t even have the DOS when 2 mason IBM execs signed the contract in Florida. Software was free back then, but masons changed the patent system so Bill could make trillions on us. Gary Kidall, inventor of the first PC operating system CP/M was one of Bill Gates first victims. A judge in 2004 agreed with Kildall’s claim that the API and look and feel of 86-DOS had been copied from CP/M.

Mason Warren Buffet funded Microsoft’s expansion. With Gates they were obliged to return most of the dark money through the Gates Foundation and the Giving Pledge, used to enable the NWO agenda.

That’s why Gates says that he’s giving 99% of his fortune away to his masonic “non-profit”, just 1% to his own blood and 99% to his blood-oath family. He’s not being generous, just a frontman returning the money to the mafia under death threat! It’s not philantropy, not only because it’s forced “donation” but also because the funds are used against humans: all those masonic billionaires are not philanthropists but misanthropists / philanthropaths !

1 https://www.officialdata.org/us/inflation/1800?amount=1

2 https://www.federalreservehistory.org/essays/panic-of-1907

https://secure.brownstoneresearch.com/?cid=MKT602858&eid=MKT610546&assetId=AST221277&page=2

3 https://www.officialdata.org/us/inflation/1800?amount=1

4 https://www.yousubtitles.com/Ronald-Bernard-cd-313284

5 Vitali S, Glattfelder JB, Battiston S. The Network of Global Corporate Control. 26 Oct 2011 PLoS ONE 6(10): e25995. https://doi.org/10.1371/journal.pone.0025995

6 https://www.globalgovernanceproject.org/cleaning-up-the-global-financial-system/t-raja-kumar/

https://merylnass.substack.com/p/why-do-the-elites-want-us-all-confined/comments

Grok comprehensive list of credit multiplier instruments

70 mechanisms that expanded credit.

Total global debt (2024): ~$305T

Derivatives notional: ~$1 quadrillion

Financialization ratio: ~10:1 vs. real economy

1. Shadow Banking & Non-Bank Lending

| Instrument | Era | Credit Role |

|----------|-----|------------|

| **Finance Companies** (e.g., GMAC, GE Capital) | 1930s–2000s | Lent to consumers/corporates **outside bank regulation** |

| **Hedge Funds / Private Credit** | 1990s–2020s | Direct lending, distressed debt, mezzanine → **$1.5T+ AUM** |

| **Money Market Funds (MMFs)** | 1971+ | $6T+ pool → funds repo, CP → **parallel banking system** |

| **Repo & Reverse Repo** | 1950s–1980s boom | **Secured overnight lending** → turned bonds into cash |

| **ABCP Conduits / SIVs** | 1980s–2007 | Off-balance-sheet → hid leverage (blew up in GFC) |

---

2. Structured Credit & Synthetic Products

| Instrument | Era | Credit Role |

|----------|-----|------------|

| **CDOs² (CDO-squared)** | 2002–2007 | Securitized **tranches of CDOs** → infinite re-leveraging |

| **CLOs (Collateralized Loan Obligations)** | 1990s, 2010s+ | Securitize **leveraged loans** → $1T+ market |

| **Synthetic CDOs** | 2000s | Used **CDS** to create fake bond exposure → no underlying |

| **BISTRO (JPMorgan, 1997)** | 1997 | First synthetic balance sheet CDO → freed bank capital |

| **Constant Proportion Debt Obligations (CPDOs)** | 2006 | AAA from BB via leverage → blew up in 2008 |

---

3. Consumer & Retail Credit Explosion

| Instrument | Era | Credit Role |

|----------|-----|------------|

| **Installment Loans / Hire Purchase** | 1920s–1950s | Cars, appliances → **mass consumer debt** |

| **Home Equity Loans / HELOCs** | 1980s–2000s | Turned homes into **ATMs** → $10T+ peak |

| **Payday Loans** | 1990s+ | 400% APR micro-loans → **predatory credit layer** |

| **BNPL (Buy Now Pay Later)** | 2015+ (Affirm, Klarna) | **0% teaser → revolving debt** → $300B+ volume |

| **Student Loans (Federal + Private)** | 1965+, 2000s boom | $1.7T U.S. → **non-dischargeable lifetime debt** |

---

4. Corporate & Leveraged Finance

| Instrument | Era | Credit Role |

|----------|-----|------------|

| **Junk Bonds (High-Yield)** | 1977 (Milken/Drexel) | **Speculative-grade debt** → LBO boom |

| **Leveraged Buyouts (LBOs)** | 1980s, 2004–07, 2020s | 6–8x debt/EBITDA → **private equity debt engine** |

| **PIK (Payment-in-Kind) Bonds** | 1980s, 2000s | Interest paid in **more debt** → compounding leverage |

| **Mezzanine Debt** | 1980s+ | Subordinated + warrants → **bridge between debt/equity** |

| **Unitranche Debt** | 2010s+ | Blends senior + junior → faster, pricier loans |

---

5. Government & Supranational Credit

| Instrument | Era | Credit Role |

|----------|-----|------------|

| **Treasury Bonds (Long-Term)** | 1917+ | **Risk-free benchmark** → all credit priced off it |

| **Agency Debt (Fannie, Freddie)** | 1938+ | Implicit guarantee → **$8T+ mortgage credit** |

| **Municipal Bonds (Munis)** | 19th c., 1970s+ | Tax-exempt → **local gov’t leverage** |

| **Supranational Bonds (World Bank, EIB)** | 1940s+ | AAA credit → funds emerging markets |

| **Sovereign Wealth Funds as Lenders** | 2000s+ | Norway, UAE → direct project loans |

---

6. Trade & Supply Chain Finance

| Instrument | Era | Credit Role |

|----------|-----|------------|

| **Letters of Credit (LCs)** | Medieval → 20th c. | **Bank-guaranteed trade** → global supply chains |

| **Factoring / Invoice Financing** | 1900s+ | Sell receivables → **instant working capital** |

| **Supply Chain Finance (SCF)** | 2000s+ | BigCo pays supplier via bank → **hidden corporate credit** |

| **Trade Finance Securitization** | 1990s+ | Bundle LCs/invoices → sell to investors |

---

7. Insurance-Linked & Catastrophe Finance

| Instrument | Era | Credit Role |

|----------|-----|------------|

| **Catastrophe Bonds (Cat Bonds)** | 1997+ | Insurers **securitize risk** → investors fund disasters |

| **Insurance-Linked Securities (ILS)** | 2000s+ | Reinsurance → **alternative risk capital** |

| **Life Settlements** | 1990s+ | Buy/sell life insurance → **death as collateral** |

---

8. Emerging & Exotic Instruments

| Instrument | Era | Credit Role |

|----------|-----|------------|

| **Eurodollar Futures** | 1981 | Price **offshore USD rates** → global benchmark |

| **Interest Rate Swaps (IRS)** | 1981 (IBM–World Bank) | **$400T+ notional** → core of fixed/floating |

| **Credit Default Swaps (CDS)** | 1994 | **Debt insurance** → enabled naked shorting |

| **Total Return Swaps (TRS)** | 1990s+ | Synthetic ownership → **leverage without balance sheet** |

| **Variance Swaps / Vol Selling** | 2000s | Bet on calm → **blew up in 2008, 2018, 2020** |

| **Contingent Convertibles (CoCos)** | 2010s+ | Bank debt → equity on trigger → **regulatory arbitrage** |

---

9. Digital & Crypto Credit (21st Century)

| Instrument | Era | Credit Role |

|----------|-----|------------|

| **Stablecoins (USDT, USDC)** | 2014+ | **Digital dollars** → on-chain lending collateral |

| **DeFi Flash Loans** | 2020+ | Borrow $100M+ **uncollateralized for 12 seconds** |

| **NFT Collateral Loans** | 2021+ | Borrow against digital art → **new asset class debt** |

| **RWA (Real-World Asset) Tokenization** | 2023+ | T-bills, real estate, invoices → **on-chain 24/7 credit** |

---

10. Central Bank & Monetary Plumbing

| Instrument | Era | Credit Role |

|----------|-----|------------|

| **Federal Funds Market** | 1913+ | Banks lend reserves → **base of money multiplier** |

| **Discount Window** | 1913+ | Fed as **lender of last resort** |

| **QE (Quantitative Easing)** | 2008, 2020 | Buy bonds → **inject credit directly** |

| **Repo Operations / Standing Facilities** | 2008+ | Central banks **fund dealers** → infinite liquidity |

| **Currency Swap Lines (Fed + ECB, BoJ)** | 1960s, 2008+ | **Global USD faucet** → prevents dollar shortages |

## Mega-Trend: **From Balance Sheet → Market → Synthetic → Digital**

| Phase | Credit Form | Example |

|------|-------------|---------|

| **1900–1950** | Bank loans, bonds | Relationship banking |

| **1950–1980** | Securitization, Eurobonds | Originate-to-distribute |

| **1980–2008** | Derivatives, CDOs | **Synthetic credit** |

| **2008–2025** | QE, DeFi, tokenization | **Centralized + decentralized credit** |

9 steps out of global tyranny

Sep 10

Time after time, most have become disappointed with their political leaders, in whom they placed their hopes for change. What they don’t realize is that the root of the problem is the system:

The PLAN revealed

This research took many many hours (including late night work), that will save you that amount of reading and organizing ideas. If you like it, please consider a paid subscription:

Are you prepping?

They are manufacturing a the huge infrastructure and financial crisis !

Have food and water for 3 weeks !

Yellow alert: global cyber-storm

20 December 2024

Due to the urgency, I’m not including the usual footnotes supporting everything I write. I’m working on the promised pieces. In the meantime, I’ll be releasing some articles I had been baking for a while, which needed polishing.

20 laws we need to exit Extermination Planet

Laws to exit planet prison

No Free Speech without Reach

Why was Bill Gates the mentor of Zuckerberg?

Zuckerberg really flipping?

15 Jan

What Has Happened To Mark Zuckerberg?

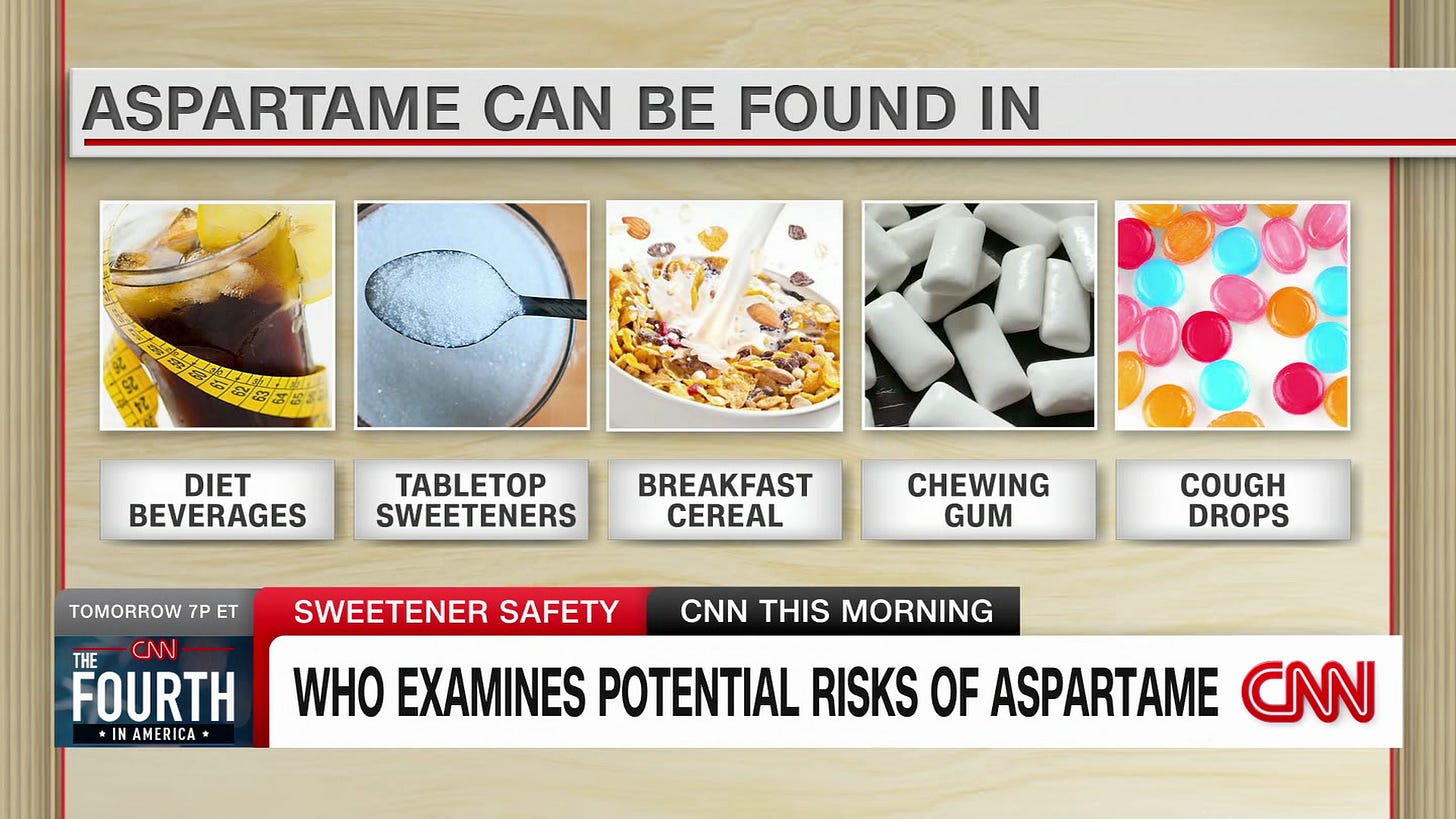

How Rumsfeld forced the approval of lethal Aspartame.

Artificial sweeteners, MSG, PFAS, Glyphosate ... go organic!

Why is food poisoning legal?

26 November 2023

This article would be another tool you could share to keep waking-up the still-trusting sleepwalkers: some reject discussing injections, but they’d be open to food.

Solutions for “this” Democracy?

Rethinking science

19 December 2023

Unless we change it, we’re doomed to the next PLANdemic. And yet, nothing has changed, only got worse! This isn’t pessimism: just a realistic call to ACTION in the medical and scientific freedom communities.

Rethinking education for the real 21st century:

Why not earning $60,000 per year for educating your own children?

Call to action

1. Please share in social networks!

10 shares = waking up more people + especial gratitude:

Waking others up SAVES lives or livelihoods.

For example, send them free ebooks:

Vax-Unvax: Let the Science Speak

The more the awakened, the sooner this nightmare will be over !

2. Please subscribe

Scientific Progress is a reader-supported publication. To receive new posts and support my work, please consider becoming a free or paid subs:

3. Show your love in the tip jar =)

1 dollar makes a difference !

4. Please consider “buy me a coffee”:

5. Please reconsider a paid subscription:

6. Please consider commissioning an article for the topic of your preference:

7. Pray

Most important of all: let’s pray for each other and the conversion of our enemies !

The evil we see in the material world is just the echo from the spiritual battle between God and Satan and their followers, either human or angelic.

Darkness grows because the light of faith is fading. Faith is the root of a plant that withers without the sunlight of love and the water of prayer. God is love: ask Him for more faith in love.

Fascinating writeup, much appreciated (small spellcheck at very end, ‘philanthropists’ and ‘misanthropists’). Cheers, Tom

Have:

- good relationship with God, neighbor and self

- knowledge (farming, foraging, building, defense)

- tangible assets

Keep learning, keep praying